san mateo county tax collector property tax

Pay Transient Occupancy Tax. The median property tax also known as real estate tax in San Mateo County is 442400 per year based on a median home value of 78480000 and a median effective property tax rate of 056 of property value.

If your Unsecured property tax payment is not received or postmarked by the delinquent date a 10 penalty and a 3500 collection fee are added to your bill.

. Each of them are responsible to the public for the assessment collection and distribution of property taxes as well as other. However they are still required to file a statement if requested by the Assessor. Feb 14 2022 - Mar 11 2022.

City Of San Mateo Bond. Search and Pay Property Tax. In San Mateo County the heads of these offices are elected officials.

There is no charge for filing for the Homeowner Exemption. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner. The median property tax on a 78480000 house is 439488 in San Mateo County.

San Mateo County collects relatively high property taxes and is ranked in the top half of all counties in the United States by. The treasurer-tax collector serves as the storehouse of county funds managing investments and debt and as the biller and collector of its property taxes. 2022 Property Tax Re-offer Auction.

Treasurer-Tax Collector San Diego County Admin. Click here for Property Tax Look-up. San Mateo County Treasurer-Tax Collector.

You also may pay your taxes online by ECheck or Credit Card. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143. Total Ad Valorem Taxes 114440000.

What is the property tax rate in San Mateo County. The law provides property tax relief to property owners if the value of their property falls below its assessed value. 3-days Left to Register by May 5 th.

Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. 1 Look Up State Property Records by Address 2 Get Owner Taxes Deeds Title. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800.

If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill. Enter a Parcel Account Property Address or Bill YYYY-. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

2019 2022 Grant Street Group. With a median home value of 784800 San Mateo County homeowners can expect to pay an average of 4424 a year in property taxes. Announcements footer toggle 2019 2022 Grant Street Group.

Ad View State Assessor Records Online to Find the Property Taxes on Any Address. San Mateo Countys average tax rate is 056 of assessed home values which is one of the highest in California. Just call 1-877-496-0510 and use our interactive voice response system.

The local assessment roll is. New property owners will automatically receive an exemption application in the mail. Making a payment can be as easy as making a telephone call.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Mateo County Tax Appraisers office. SEARCH SELECT PAY ITS THE BEST WAY. The property tax process in San Mateo County like most other California Counties is split between three different offices - the Assessor the Controller and the Tax CollectorTreasurer.

If your bill remains unpaid for two additional months a monthly penalty of 1 and 12 begins to accrue. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. The median property tax on a 78480000 house is 580752 in California.

Enter a Parcel Account Property Address or Bill YYYY- Loading Search. You can also make a payment or get more information and assistance by calling us at 650 363-4155 and speaking to a Revenue Services staff member. Contact Property Tax Accounting Staff if you have questions relating to refunds.

Summary of Valuations of Property in the Assessment Rolls of the County. The Tax Rates and Valuation of Taxable Property of San Mateo County publication includes. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available.

Search and Pay Business License. Center 1600 Pacific Hwy Room 162 San Diego CA 92101. Im interested in running for.

Some San Mateo County property owners whose properties were in the Decline in Value Assessment Program may see an increase restoring to factored base year value in their assessment values by more than two percent 2. San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. Homeowners Property Tax Exemptions.

For more information call 6503634501. Assessed Valuation by Account. You can then pay by credit card right over the phone.

In fulfilling these services the Division assures that the County complies with necessary legal. In addition if a Certificate of Tax Lien is recorded by the County of San Mateo Tax collector an additional fee of 1300 will.

Drainage Manual Planning And Building

Secured Property Taxes Tax Collector

Secured Property Taxes Tax Collector

San Mateo County Ca Property Tax Search And Records Propertyshark

San Mateo County Hazards Existing Landslides Planning And Building

San Mateo County Property Values Reach Record High For 11th Year In A Row

212 Eaton Rd Apt 23 San Mateo Ca 94402 Realtor Com

Green Infrastructure Planning And Building

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Adopted Maps Planning And Building

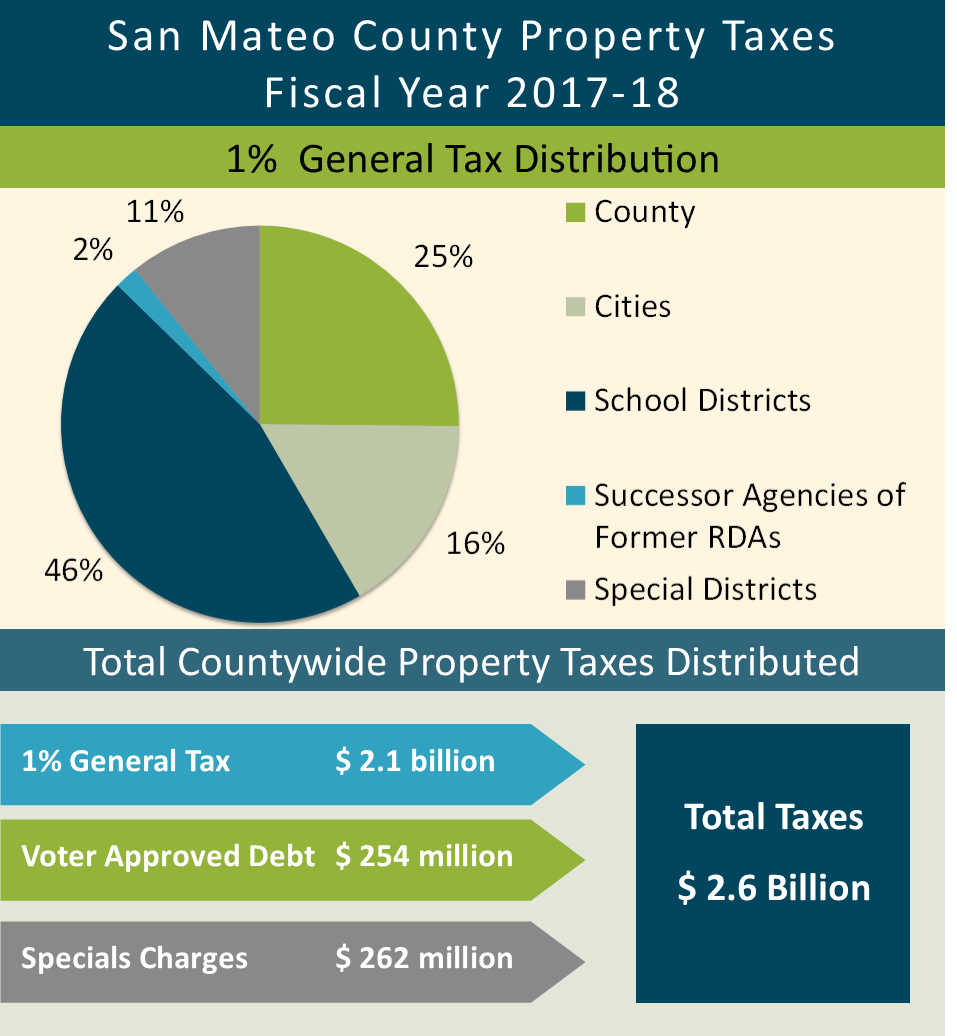

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Secured Property Taxes Tax Collector